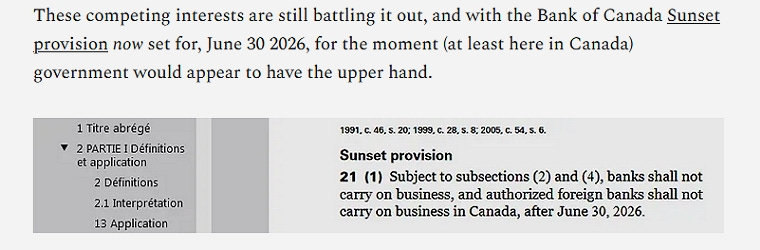

As you may recall from my last post — ‘Monetary Machinations’ — I included an excerpt from the Canadian Bank Act: ‘The Sunset Provision.’ Since I’ve talked about this already, maybe it isn't surprising that a couple of my artist friends, caught that italicized ‘now.’

The reason for this (as I draw your attention to a previous version of the document below) is that the date set was June 30 2025, until December of last year (according to the Wayback Machine), and now that date, as you see above, is 2026.

I've received some educated guesses about what this means. The consensus, from a number of friends in the financial world, is that all of the banks’ charters are to come due at one time, and that bankers would then have to sit down with the government to renegotiate. I mentioned last time, that the history of money has always been a struggle between governments and bankers for the power to create money, but what is so odd about this date change?

The process to modify legislation requires another piece of legislation: ‘Legislation is introduced in Parliament to amend or repeal existing laws or put new ones into place.’ I was lucky enough to have dinner last week with Maxime Bernier (Matthew Ehret and Cynthia Chung) and this was something we discussed for a while. It was Max who pointed me in the right direction, and that legislation, not surprisingly, was the last budget: Bill C-69

397 DIVISION 41

‘Legislation Related to Financial Institutions (Sunset Provisions)’

Not surprisingly, the Liberals and NDP voted in Lockstep again for this piece of Legislation; the Conservatives and Bloq voted against it. What might seem odd, understanding how much bargaining power this provision gives the administration in power, is that the Liberals would vote to move this item back beyond the next election date to when (presumably) the Conservatives will be in power; and that the Conservatives would vote against this. Of course, this issue is buried in the text and not discussed; and the Conservatives voted against the bill as a whole.

However, I spent a long time looking for discussion on this subject, and I invite everyone here to dig through the Hansard text themselves. From a monetary reformer's point of view, it is amusing, or disheartening (depending how you look at it), to see what is still being argued in Parliament (on the subject of budgets and taxes).

‘An hon. member: Monetary policy is not fiscal policy.’

Ms. Michelle Ferreri: I love how the Liberals across the way are defending the Prime Minister, who said to the reporter, “Glen, we took on debt so you don't have to”.

An hon. member: No, you just don't know the difference between monetary policy and fiscal policy. They are two different things —’

Now, the Modern Monetary Theory (MMT) folk would argue that taxes are actually part of monetary policy, despite what text books tell us. So are the Conservatives ahead of the curve here? This is another subject though (for another day), but if we dig back through the archives we can see how this ‘Sunset provision’ has come up before, many times; like something of a ‘hot potato’ it seems. This section must always be updated ahead of the most recently revised date, but otherwise, it might just as well be invisible.

‘An Act to amend certain Acts in relation to financial institutions’

‘Version of section 21 from 2018-06-21 to 2021-06-28’

‘Version of section 21 from 2021-06-29 to 2024-06-19’

‘Version of section 21 from 2024-06-20 to 2024-08-18’

And so on. I see this slightly differently though, as the title above suggests, and I'll return to this in a moment.

Back to some other economic / monetary basics, as we revisit ‘the history of money’:

As everyone should know by now, those who have the power to create our money also profit from this privilege; because the interest on this money flows back to them. This is the reason usury has often been frowned upon, and at various times in history, prohibited (yet another long story). The above is true of money created as loans by commercial banks, but interest on debt (in the form of government securities — bonds and such) flows back to those who hold the debt too. Needless to say, a large portion of our national debt is held by the commercial banks as reserves.

Some bonds are held by pension funds of course (something that might be regarded as positive), but most of you here will understand that a great many bonds are also held on the balance sheets of central banks, accumulated there during periods of quantitative easy (during the ‘Lockstep’ orchestrated Covid lockdowns for example). In this situation, we are essentially paying interest to ourselves, but (as mentioned in my July 4th post ‘Bank Heist: A quarter century (or more) of daylight robbery’) it was decided in Canada that the central bank would no longer pass these payments on to the government. Enriching the commercial banks (the private money creators) yet again, at the expense of the public.

So what will happen when (or leading up to) the exercise of the ‘Sunset Provision’ ? Answers have not been forth coming from those we might expect to have answers, though I ask this question again now, and will report back — if the Bank of Canada and/or Minister of Finance provide any additional information. Your local bank manager, I can pretty much guarantee, has no clue.

When the date was set at 2025, rumours swirled. The fact that Klaus Schwab's The Fourth Industrial Revolution establishes 2025 as a target date to have a lot of things, ‘Deep Shifts’ he calls them, in place (leading up to 2030).

The obvious theory: There will be no need for commercial banks when we are all using Central Bank Digital Currency. The banks would be essentially redundant in this scenario — should all ‘money’ be created by the Central Bank, and pushed out into the economy in various other ways; including, of course, Universal Basic Income (UBI). Naturally, it is somewhat more complex than this, as I've discussed before, because the existing debt-based money ‘Ponzi Scheme’ is a sophisticated Public-Private Partnership — a collaboration between our publicly-owned Bank of Canada, and commercial banks, that allows ‘private’ banks to profit while ‘risk’ is unwittingly assumed by the ‘public’ owners of the BoC. . . all of us, that is.

A few people, thankfully, are starting to realize this, and when the scheme collapses (as all Ponzi Schemes do) the public will be left holding the bag (the way all public-private partnerships are designed). The government will be called upon to ‘bail-out’ or ‘bail-in’ the bankers, with your tax dollars or newly created (inflation causing) central bank money (in the first scenario) and your actual savings (in the second).

It was not unreasonable to assume (given how little information we actually have about what is really going on behind the scenes) that this would be the time to introduce CBDCs — when a lot of people have no choice but to accept. In such a situation, the government could impose all manner of conditions. The programmability of this digital ‘expression of money’ would allow for tracking and massive data collection of course, restrictions on use (what you’re allowed to purchase and where), a set time within which your UBI allowance must be spent, and also, real-time taxes and fines. Your new financial ‘privileges’ could also be turned off should some technocrat (or authoritarian Finance Minister) decide they don’t like your behaviour. Then you’d have to turn yourself in to the authorities to pay the fine (or accept whatever punishment they deem appropriate) and promise to not misbehave again.

Let's forget the Bank of Canada's announcement that it would not be pursuing CBDC because of the overwhelming negative results from last year’s public survey. All you really need to know:

‘Instead, the central bank said its focus will be on preparing for the ongoing evolution of payments both in Canada and around the world, through policy research and analysis.’

So really, nothing much has change. As I described above, CBDC should never have been thought of as money (as most people understand it). CBDC was always a payment system and the Bank of Canada's policies (I would suggest) were never in the interest of the public. In a future piece, I will include screen captures of my suggestions in the BoC survey in which I highlight the importance of a ‘neutral’ currency. The definition of a neutral currency, of course, is one that does not have attributes (such as those described above), by which ‘policy’ can be forced up individuals directly — by either a captured central bank or an ideologically driven (and/or captured) administration. This is the only way to remove politics from money. I've had numerous debates with my monetary reformer friends online, and the point I always make is:

It might seem a good idea now [to some] to allow Net Zero policies (for example) to be imposed by means of credit ‘conditions’ and restriction on the use of currency, but what happens when another administration comes in and enforces ideas that [these same folk] absolutely don't like?’

It is only common sense, in my opinion, that money must be neutral. It is the only way to keep the system honest and to ensure that radical authoritarian administrations (left-wing or right-wing) cannot exercise ‘absolute control’ over individuals. This is maybe the only insurance we have against full totalitarianism.

As our friend (the 21st Century) Adam Smith always says:

“Power doesn't corrupt; the corrupt seek power."

Should the corrupt attain power though (by whatever means) absolute control of the monetary system would immediately give them absolute control of the people. As Harvard’s Christine Desan has stated:

‘Money can be designed in ways that are democratic or dictatorial.’

So the corrupt (at all levels of government) should be identified and removed — and the money should be created in a way that it too cannot be corrupted. Let me quote again from Bertrand Russell’s The Impact of Science on Society, ‘Effects of Scientific Technique’ (pg 23):

‘Unfortunately, however, the men whom the police wish to catch are frequently benefactors of mankind. If the telegraph [CBDC or global digital payment systems] had existed, Polycrates would have caught Pythagoras, the Athenian government would have caught Anaxagoras, the Pope would have caught William of Occam, and Pitt would have caught Tom Paine when he fled to France in 1792.’

To this end, I have also made the suggestion that, instead of a Central Bank Digital Currency CBDC, the Central bank might look at what I call a Central Bank Electronic Currency (a ‘CBEC’). Please revisit an earlier post here: ‘The Electronic vs. Digital Debate Continues.’ You can see though (I hope) that we're in a bind here: if we continue to use commercial bank created private money, or the billionaire's new private payment systems, those who own the money or control the systems get rich at our expense (and they will end up owning all real assets). If we let the current captured governments and central banks to introduce a CDBC, we will be slaves to the Davos technocratic psychopaths. Either way, we lose. . . and we lose BIG.

So we need a whole new model (I would suggest). Electronic money could be produced by the government (and its central bank); and by ‘electronic’ I mean not programmable — not ‘digital’ therefore. So this isn't just semantics (as I’ve suggested) but real defining characteristics by which we can establish the meaning of these words. This was the reason for my little fight with TD bank on the subject of digital vs. electronic. Of course it went no where, because they see this (technocrats that they are) as a ‘policy question’ — nothing else outside of this exists. We're in a new (postmodern) era, and we need hard and fast definitions for the words we use.

Physical cash cannot be eliminated of course. . . look what's happening in the Carolina's now. Cash (and small denominations of precious metals) are the only things that allow trade (once again, as they have for hundreds of years). Forget the Satoshi Nakamoto CIA experiment (CBDC, digital currency conditioning PsyOp) ‘Bitcoin’ — for reasons that should be obvious by now (and to which I must return later).

I'm tempted to go on (and on); we monetary reformers just can't help ourselves because we can see the injustice, and we can see a better way to ‘do’ money. I'll save all the suggestions I made in this survey for later. I spoke regularly on this subject for a long time and there's so much more to share from being in the trenches, with real people (rather than technocrats at the BIS and related organizations).

So nothing has changed, other than the Bank of Canada (and Canadian government) now knows the public will not ‘willing’ accept their new scheme. That ‘Sunset Provision’ is the government's trump card (in that it can call anyone who wants to operate a bank in this country to the table). However, there are two key points:

All of the assets in this country are at stake here, and we already know the private bankers and government collaborate in the existing public-private (monetary) partnership. It could be they haven't yet figured out how to divide the loot. Pushing back that Sunset provision allows those at the table time to hammer out a deal both sides can agree to.

Some time must be allowed to pass for the ongoing ‘controlled demolition’ to look natural; so that (when it happens) people will have forgotten everything, and will be so desperate that they'll accept anything.

I mentioned in my last piece on neoliberalism, that conservatives, and especially Libertarians, are going to be advocates for private money solutions; while Liberals will demonstrate their Communistic authoritarian tendencies (disguised as altruistic and environmental motives) by advocating for central planning, surveillance and enforcement, by means of programmable currency and payment systems.

Both side (as it's almost certain neither side understands the nuances of money) will likely advocate for the BIS Unified Ledger, tokenized assets (of all manner) and digitization of all records of ownership (much of this has already happened). All of these things together will give total control (and ultimately ownership of everything) to a technocratic elite, above even the current ‘puppet’ political class.

‘Autumn — On the Hudson River’ 1860 Jasper Francis Cropsey (detail)

So this Sunset provision isn’t just the government’s trump card, rather, it is something more like that proverbial ‘football’ briefcase (containing the launch codes for the nuclear arsenal) that accompanies the U.S. President where ever he goes and is passed on, administration to administration. The Sunset provision is ‘nuclear’ in another way. Can you imagine the effect of halting the operations of all financial institutions in Canada? It would be ‘the end of the world’ for those who haven’t a clue what the ‘stakeholders’ are talking about behind closed doors; but of course, this too is just a deterrent.

A ‘Great Reset’ ( if it isn’t ‘ready and waiting’ in the wings) will be hammered out, and the Sunset provision is how it will happen here in Canada (I would suggest) — under some other dubious ‘Emergencies Act’ of course.

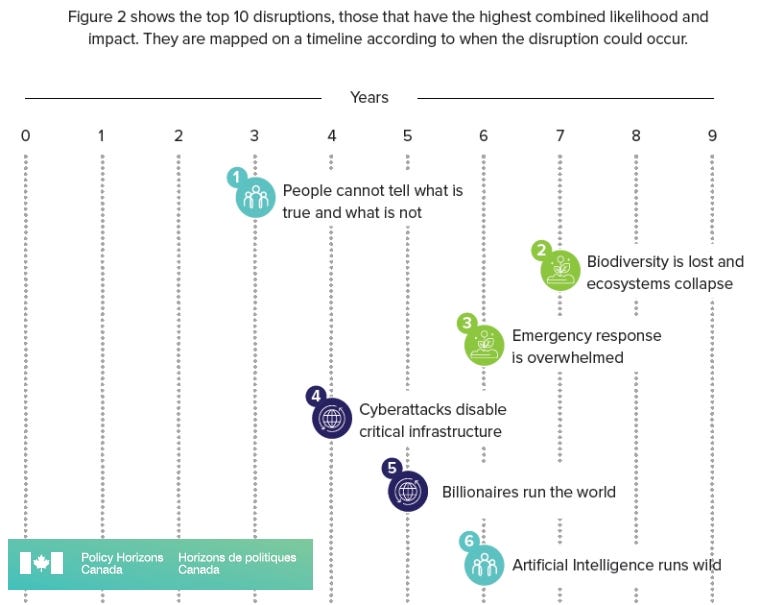

The stage is being set for a ‘disruption’ of this nature; hence the the latest ‘Policy Horizons Canada’ study. From Service Canada - Disruptions on the Horizon — 2024: Billionaires will rule the world in five years (taking us up to the threshold of 2030). Some would suggest billionaires already run the world; forget about CBDC, maybe we’ll all be using Alipay and their ‘global partners’ for all of our ‘digital payments and financial inclusion’ needs by then. Even if the people who wrote this document don't understand the difference between monetary policy and fiscal policy either, I suspect they see some other trend — clearly visible by now.

There is so much more to say on all of this. In the meantime though, I know you won’t be able to resist skimming through the document above. I will share whatever more I discover on the subject of that Sunset Provision later, and we must continue this conversation soon.

Thank you again for your interest and on-going support.

David

WE need to focus on how to make governors of our minds obsolete.

I thought I should move the link you sent up here, Kara, where people will see it.

Coincidentally, I had lunch with Ulrike (who interviews Dr. Michael Nehls here), about three weeks. She was in Toronto for another event. . . It is a very small world, as you know :-)

Thanks for sharing this: https://www.youtube.com/watch?v=v8FnqQDj_WQ