Everyone is talking about taxes these days, and about cutting government waste; especially our Libertarian friends. They are correct to think this way; we should be making cuts, for all kinds of reasons. One figure bandied about is a 5% per year property tax reduction. In my last piece, I mentioned why we can’t reduce our debt this way, and I explained why. I’ll continue soon with options for escaping our debt-money ‘bondage,’ but here, we’ll look at some ways to cut out the deadwood that has sprung up these past few years. Let’s set the tone with a video I referenced last time (in case you missed it). There’s no reason we can’t have some fun here - DOGE Days:

“There’s a whole forest of deadwood out there, we’ve gotta get chopping !”

‘Specialists,’ Tanner and Blaise, replace a heavy five-gallon water container with the ‘Manager of Office Logistics.’

You may recall an earlier post in which I mentioned the redrafting of our Region’s proposed Strategic Plan — not that the Region will pay any attention, but a group of concerned Uxbridge residents have undertaken this task anyway, in the hope that we’ll get support. I’ll include the reworded document in a short follow up post before Christmas. You’ll see we’ve remove all of the United Nations verbiage, questionable climate assumptions and Globalist programs that will increase taxes and place massive restrictions on our lives. You’ll also see this version includes the promise of tax reductions (for a change). Since these ‘framework’ documents can’t contain much in the way of specifics, I’d like to make a few suggestions here, if you care to read on.

I was set on this track last Wednesday (Dec 11th) when I attended a Durham Region Committee of the Whole meeting (1:49:40). A lot of people would agree (even those not paying property tax directly) that the Region doesn’t need an additional personal pronoun policy or mandatory ‘Ableism Attitude’ training. We also don’t want to pay for another diversity audit / census, or a ‘breast feeding / chest feeding policy’ — as suggested by the Region’s ‘Equity Audit Specialist.’ I was curious, naturally, what such programs might cost the taxpayer. I’m hoping someone here will take up the challenge (and if you’re not in Durham Region, you might still consider looking closely at your own Region’s spending on such things), but the first (and easiest) information to pull up is the remuneration this new class of ‘specialist’ employee enjoys.

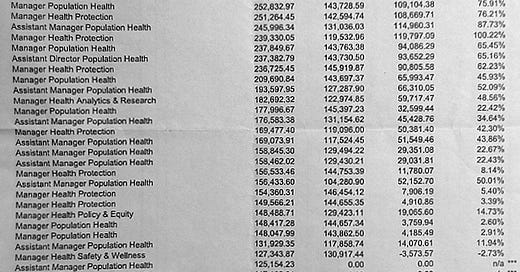

It took only five minutes find the Director of Diversity, Equity and Inclusion’s Salary: $176,568 in 2023, up from $163,145 in 2022 (a nice 8% + increase there). The Equity Audit Specialist’s salary, as it’s not on the Sunshine List, can only be guessed at:

Payscale › research › CA › Job=Audit_Specialist › Salary. Average Audit Specialist Salary in Canada - Payscale Sep 28, 2023. The average salary for an Audit Specialist in Canada is C$80,000 in 2024.

I know it will seem mean-spirited (at this time of year especially) to even consider looking at such personal information, but there is nothing actually personal here. Since our towns are reviewing budgets at the moment, everything in these budgets should be considered, and particularly when some strange (and costly) distortions have occurred in recent years.

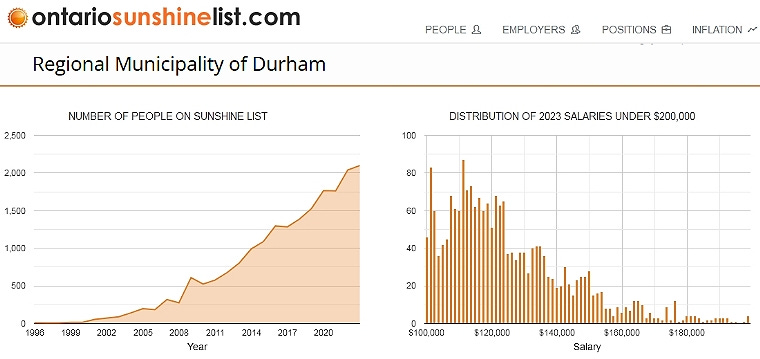

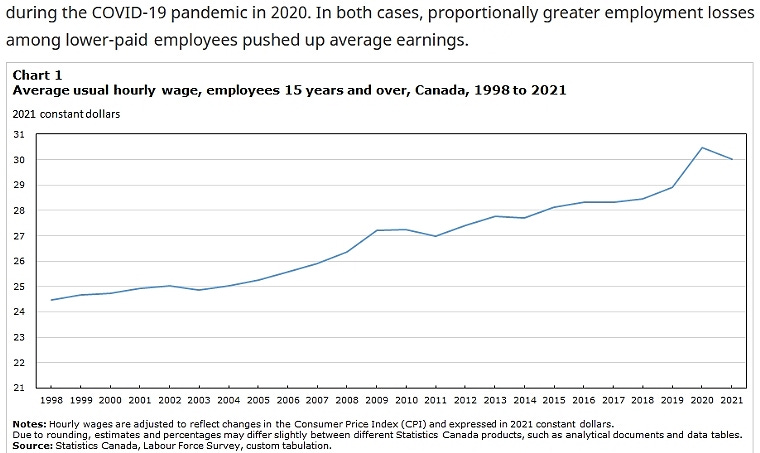

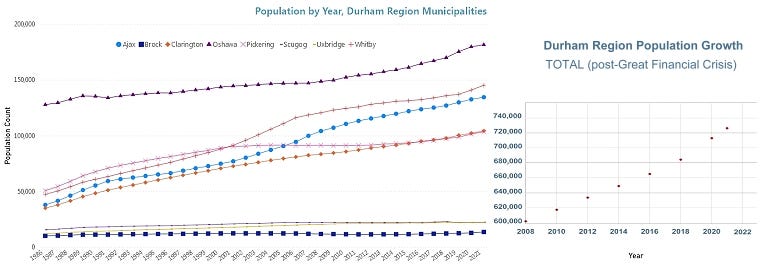

You’ll notice a pronounced increase here (on the left) beginning in 2000, but kicking off in earnest at the time of the Great Financial Crisis (GFC), in 2008. It is often the case with government, that when some crisis or another (Y2K, GFC, Covid) has the public distracted, those in the public sector seem to do especially well — when compared to everyday people in the private sector. From Statistics Canada:

Here we see, from the 2008 GFC to 2021, an increase in hourly wages from around $26.30 to $30 — an increase of 14% in just over a decade. This equates to an average $60,000 in 2021, up from $52,600 in 2008 (in adjusted dollars). I invite everyone, of course, to question any of these numbers (and to dig deeper yourself). Now, as you can see, the public salaries above are in a whole other class, and I will be criticized for comparing apples and oranges here. So let’s look at another metric: Sunshine List salaries relative to population, 2008 to 2021. Durham Region Population Data Tracker (click on ‘Trends):

You can see that in 2008, the Region had 276 employees on the Sunshine List, while the population of the Region was 603,054. By 2021 however, Durham had 727,328 residents. That’s an increase in population of 21%. Meanwhile, by 2021 the Region had 1763 Sunshine List employees, which is an increase of roughly 640%

Again, someone will criticize me for not considering the ‘inflation effect’ here — which is really an ‘indexed salary conveyor’ — that inexorably moves more and more staff into the Sunshine. Of course, it’s okay when your salary is ‘inflated’ into a new tax bracket, no government will worry about that. But this isn’t the real problem; rather, I suggest, we should be looking at those many new positions that governments, at all levels, have conjured up over the past few years.

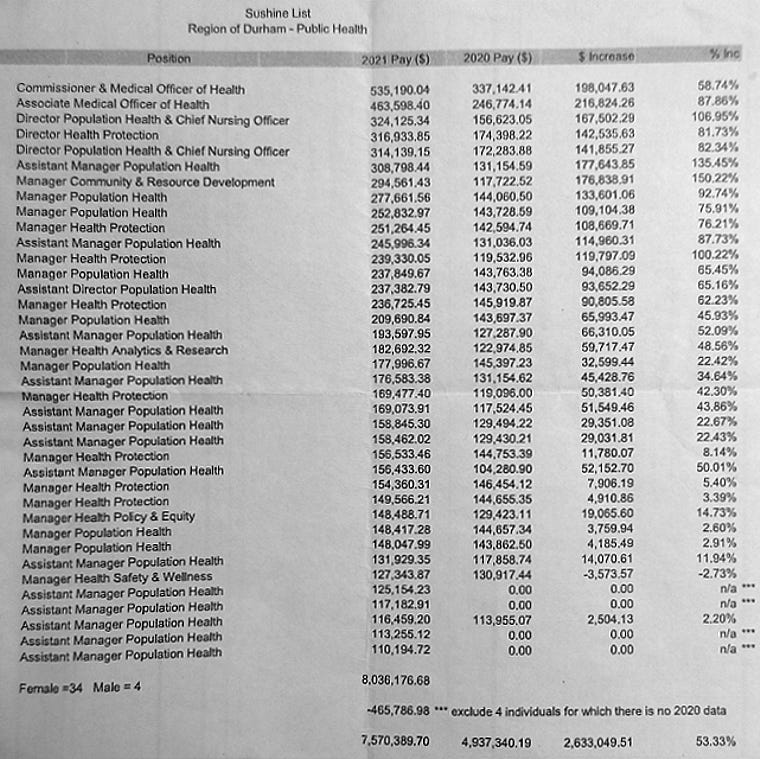

Under cover of dark (lockdown days), the following piece of paper circulated widely. The ‘health emergency’ is now officially rescinded, but the jobs don’t go away (only the rate of increase diminishes slightly). Funny how that works in government; but you must admire the creativity involved in coming up with so many new titles, all describing essentially the same thing (an ‘array’ of Sunshine):

And this is just Durham Region. Afuera, Afuera, Afuera.

What we are seeing here is not just the kind of government waste and inefficiency portrayed by ‘Tanner and Blaise’ et al, in the ‘cutting deadwood’ video above. Spending on ‘make-work’ projects and outright cronyism (apparently) has been on the rise, but this isn’t just an administrative or budgeting problem. What we are observing here, I suggest, is the rise of (and preparation for) the Biosecurity Technocratic State.

With the WHO’s proposed ‘One Health’ on our doorstep, and Bill C-293 still looming (See: ‘Plandemic Preparedness’), the new health technocrats are not likely to be let go anytime soon. There is plenty of intrusive ‘make-work’ to be done in the meantime, and in the coming world of permanent ‘health emergencies,’ the ‘health technocracy’ will control every aspect of your life; including what you eat, when and where you travel — because those virus ‘vectors’ lurk, unseen, everywhere. It might be worth revisiting the contents of this so-called Pandemic Prevention and Preparedness document, and if you haven’t already, please write to our Senators.

The money involved seems almost irrelevant when we understand that we're actually seeing the birth of a new anti-democratic (and authoritarian) system. That’s what technocracy is of course, and we'll continue to explore ways to prevent this fate. For now though (seeing this in a whole new light) let’s get back to the subject of money.

Clearly, the dollars we’re talking about here are significant, but reducing employees pay won’t make a noticeable impact, unless the cuts are deep. It’s essential, also, that a lot of those ‘specialist’ positions be eliminated too. I made a rough calculation below, and I hope a few of you will start playing with these numbers as well.

In 2021 there were 243,048 households in Durham, the average property tax was $3,318 annually, or $277 per month.

From the April 2024 article, ‘Thousands of Durham government workers on 2023 Sunshine List’ (durhamregion.com), we see 2090 Region employees + 785 town employees (2875 all together). The total cost for Sunshine List employees was, in 2022: $253,938,410.97

If we’re to add 785 Town staff, at the lowest pay (for sake or argument), of $60,000, there’s another $47,100,000 That’s $301,038,411 total. A third of a billion dollars seems like a lot of money — it is a lot of money — but a 10% cut (double the suggested first year decrease) is $30,103,841 This divided by 243,048 households is only $123.86 per household. Still that’s a 3.73% reduction in your taxes. Do check my math of course, and please look at all of these numbers yourself. It’s budget time, so why not put more suggestions forward, and perhaps we can actually make that first 5% cut.

It wouldn’t be fair to suggest anyone making $60,000 take a 10% cut, but bringing a few of those now enjoying the proverbial Sunshine, back into a still very comfortable shady area (somewhere below 100K) shouldn’t really be too much to ask. “We’re all in this together,” after all.

The real savings though, will come with the “Afuera, Afuera, Afuera.” Any position created from 2020 on, should be on the block, and the most egregious (and most costly) should go first: Surplus to requirement health officials (in the post-‘health emergency’ world); those DEI, ESG, SDG folk (all United Nations affiliated staffers in fact); those who depend on the so-called ‘Climate emergency’ for their jobs — particularly as the information upon which this climate emergency was called was not verified (the disclaimer explains), and no one at the Region (or any of our towns), apparently, wants to look at evidence countering the climate narrative. This is odd, as once the ‘climate emergency’ is ended, the savings for our Region would be huge; but it’s almost as if they don’t want to hear this good news.

Every taxpayer therefore (and not just in our Region) should embrace this problem, because the writing is on the wall — or in those proposed Strategic Plans at least. Of course it’s easier (for now) to just carry on with life as normal, and to accept whatever incremental tax increase the authorities deem appropriate, rather than get involved. But we know the next stage of the plan is coming, and in the New Fiscal Age, we can (and probably will) be taxed until we ‘own nothing’ (as they say). For those who believe they can just keep paying, there’ll be land-use by-laws, travel and food restrictions, home energy refits, regulations and mandates of all manner, to ensure compliance.

I feel I’m belabouring the point now. I hope you’ll find the information here of interest, and that you will see this as a ‘ray of sunshine’ — reason for hope in a dark, corrupt and half-crazy world. If we can just spark a little more curiosity, and a little more engagement, I believe we can stop this technocratic monster in its tracks.

Have a great week, and we’ll connect again soon,

David

As an Advocate for LESS GOVERNMENT since 1979, I applaud any discussion that will inspire Canadian voters to pay attention to a plea for LOWER TAXES.

The average working Canadians remits 55% of annual earning to all levels of government in taxes and “revenue tools” (fines and fees for permits, licenses, certificates, etcetera). With 45% remaining after “the state” takes its “pound of flesh”, its little wonder that inflation-assaulted citizens are identifying the high cost of government as the sole reason for the rising cost of living.

Whenever a Liberal, NDP, Green and (yes sometimes) a Conservative politician promises you a new “free program”, reach into your pocket or purse and place a padlock on any money you have left. Then tell them in no uncertain terms that you will campaign against any and all politicians who make promises that will inevitably result in more government with more job-killing rules and new ways to steal more of your hard earned money.

I have been the Libertarian “LESS Government Advocate” candidate in seven provincial and three federal elections for one reason: to give you at least one ballot choice to declare YOUR PREFERENCE for LESS GOVERNMENT too. I may never get elected, but at least I am encouraging every Canadian to think about how much better life could be in Canada if, say, all levels of government took only 30% of your annual earnings and you kept 70%. Keep this in mind for all future elections.

Great article David. I recall a story from a few years back where a group of small business owners in SF escrowed taxes imposed on their businesses in retaliation for what they deemed as ineffective policing during which shoplifting was basically deemed acceptable. I wonder if a similar strategy could be rolled out across municipalities as a way to fight back against the kind of waste you've mentioned